The Latest Corporate Insolvency Statistics by Industry

Following on from my article published on the 11th of this month, in relation to the number of corporate insolvencies, which showed an approximate drop of 35% in the 6 months post-Covid compared to the same period in 2019. The following now summarises these insolvencies by industry, with some fascinating results…

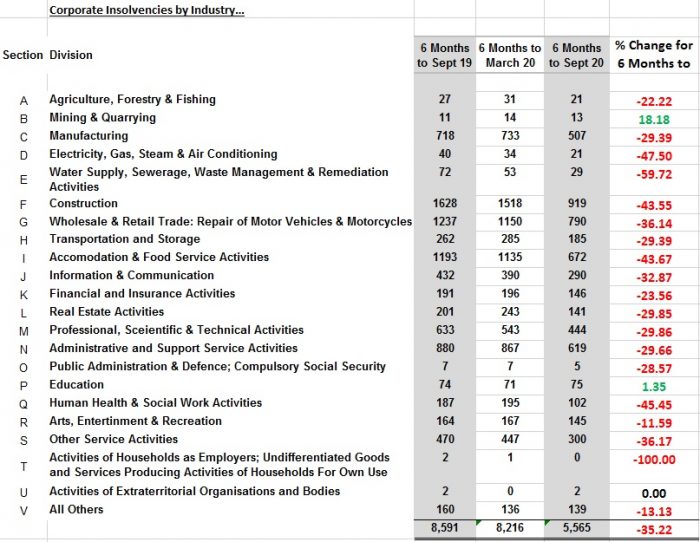

Below is a summary table of the corporate insolvencies by industry : –

What do these Corporate Insolvency Statistics show me?

- Firstly it shows that the overall number of corporate insolvencies are down by 3,026 from the same quarter in the 2019 year being a 35.22 reduction. For possible reasons for this, read my earlier article here LINK.

- The next change worth reporting is that the industries of both Mining & Quarrying and also Education, has produced greater number of insolvencies that the same quarter last year. Does this mean that not enough incentives have been given to these industries or is it simply as a result of their lower number of corporate insolvencies generally? We’d love to know your thoughts.

- The greatest reduction in corporate insolvencies per industry (based on numbers above 5) appear to be from the utilities sectors with section E seeing a 59.72% drop and section D a similarly high 47.50. So perhaps the incentives have been great for these industries or perhaps what is more likely is that with everyone being at home more regularly, the demand for utilities has risen, saving some businesses which may have previously been struggling.

- Human Health & Social Work saw a large reduction also, which is more than likely attributable to businesses downsizing.

- Surprisingly, Accommodation & Food Services was the next largest reduction in corporate insolvency numbers, which, I’m sure most of you would agree, would probably been one we would have expected to see an increase in, being an industry really suffering from the changes at the moment. My personal view on this is that as most in the industry will all be in the same boat, the breweries and HMRC will simply not have forced them into Liquidation like they previously would but I would predict these numbers to rise sharply over the coming 12 months unless greater incentives are given. Those more likely to survive will be the ones who adapt quickly and diversify.

- The last trend of note is the Arts, Entertainment & Recreation industry which saw only an 11.59% drop in corporate insolvencies. This is a clear indicator to me that there aren’t enough incentives available to this industry and that it is one of the worst affected by the Covid restrictions. Most of us will have had planned trips to entertainment venues cancelled or recreation activities which we can no longer do for some time, therefore it paints a bleak picture for those struggling in this industry, with little hope of a prompt improvement unless greater support is offered.

For those of you whom are advisors reading this article, take some time to think about the clients whom are in these industries and who is most likely to need your help as acting early and advising clients before they bury their head in the sand can be the difference between turnaround and close down.

If you read this desperately searching for your industry and worry, like us all, about the negative factors affecting your profession, just remember that everything that happens in business isn’t a life sentence, its just a lesson which we can learn from and try to adapt and stay ahead.

What can you do to survive?

- Replicate what your best performing competitors are doing

- Invest in marketing

- Would it help to furlough your staff to ride it out?

- What is your USP and is there a demand for this?

- Are you focusing on selling your highest profit margin products/ services?

- Have you cut all the costs you can?

- Have you taken advantage of all the grants available?

- Would a Bounce Back Loan or CIBIL give you the breathing space to be more effective?

- Could you get an apprentice paid for by the government?

- Has your industry changed forever and so adaptions must be made to compensate for that?

As you can see, there is lots we can all do, so my summary would simply be to take advice and keep your head up and I’m sure it will work out fine.

Click here for a LINK to the Insolvency Service website which shows the corporate insolvency statistics by industry, month-by-month.

Categorised in: Latest Insolvency News